How do I calculate my FERS retirement?

According to FERS, employees who retired received an average monthly income of $ 1,834. According to FERS, retiring employees have had a shorter average service life than CSR. FERS income is added to Social Security benefits and the Savings Savings Plan (TSP).

How do I know my retirement account balance? If you are a current employee, you should contact your human resources office. If you are separated from federal service or are currently retired, you should contact the OPM Retirement Office at 1-888-767-6738 or retirement@opm.gov.

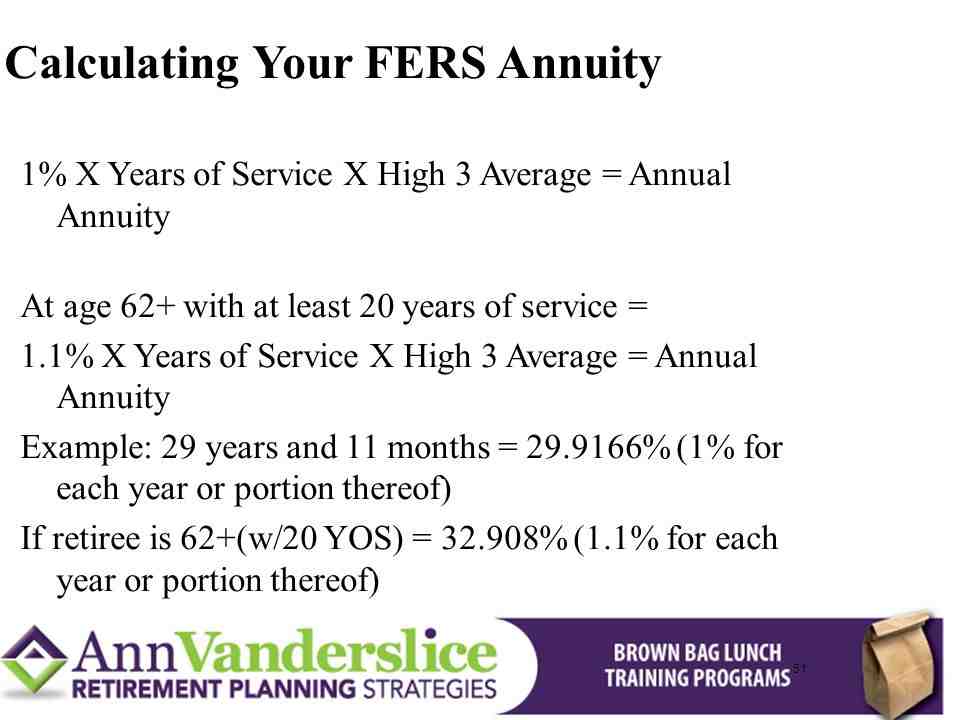

According to the FERS, employees receive a rate of 1% per year; or, for FERS employees with at least 20 years of service and working until the age of 62, the accrual rate is 1.1% for each year of service.

GS-12, Step 10, the rest of the U.S. pay is $ 95,388 in 2018. That’s used as 3, and with 30 years and less than 62 years, an annual income of $ 28,616 (with a survival of $ 25,754). At age 62 or older, that would be $ 31,478 ($ 28,330).

Can I collect FERS and Social Security?

The FERS is a three-tier system that includes Social Security, a federal pension, and a deferred tax savings plan. All FERS-registered employees are covered by Social Security. They contribute at the current tax rate and can receive the same benefits as all other employees covered by the program.

Retired FERS receive Social Security benefits and in some cases a supplement if they retire under the age of 62. CSR retirees can receive benefits in the private sector if they work for 40 quarters and 10 years. CSRS retiree benefits are reduced by Windfall Elimination Provision (WEP).

Does a pension reduce Social Security benefits? In Spanish | In most cases, no. If the pension belongs to an employer since you collected Social Security taxes, it will not affect your Social Security benefits.

Is FERS pension for life?

You are entitled to a monthly income for life after retirement. If you leave federal service before you reach full retirement age and have at least 5 years of FERS service you can take a delayed retirement. FERS retirement benefits are very generous and exceed what most private companies currently offer.

There is no short answer. Unfortunately, the misconception that you can lose federal retirement if you get fired still persists among federal employees. Many employees mistakenly believe that if the agency fires them they will lose federal retirement benefits.

If you want to leave your federal job and get a refund of your retirement contributions, you can apply for it at your staff office, fill it out, and get it back. If you are no longer in federal service, you can get the right order from our website.

According to the FERS, employees are 62 years old with five years of service, 60 with 20, MRA with 30 or MRA with 10 (but with reduced benefit).

How long does the FERS supplement last?

The supplement is reduced by $ 1 for every $ 2 of earnings above the annual limit ($ 17,640 for 2019 and $ 18,240 for 2020). It is possible for some people to remove the supplement. But the basic retirement FERS paid for your entire life will not be reduced.

FERS is a retirement plan that offers benefits from three different sources: the Basic Benefit Plan, the Social Security and the Savings Savings Plan (TSP). … Then, after you retire, you receive a monthly income for the rest of your life.

You are entitled to a monthly income for life after retirement. If you leave federal service before you reach full retirement age and have at least 5 years of FERS service you can take a delayed retirement. FERS retirement benefits are very generous and exceed what most private companies currently offer.

According to the FERS, there is no limit to profitability, as it has a lower benefit calculation – 1 percent of the 3-year high of service, 1.1 percent if they retire at least 62 years or older with the service.

Is FERS pension taxable?

If your employer funded your pension plan, your pension income is taxable. Both your income and earned income from these retirement plans are taxed as ordinary income at rates of 10% to 37%.

Nine of those states that do not tax retirement plan income do not have state taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three – Illinois, Mississippi and Pennsylvania – do not tax 401 (s) plans, IRAs or pension distributions.

If an employee dies and the survivor’s income is not paid according to his or her death, he or she must pay the retirement contributions left by the credit in the Civil Service Retirement and Disability Fund, as well as the corresponding interest.

Income from retirement accounts and pensions is taxed at some of the highest tax rates in the country. Social Security retirement benefits are exempt, even if the cost to the state is high, it will be difficult for most seniors to live in California with only Social Security income.

Can I cash out my FERS?

You can withdraw basic benefit contributions if you leave your Federal job. However, if you do so, you will not be able to take advantage of the service covered by the refund. There is no provision in the law to reimburse FERS contributions for refunds.

If you want to leave your federal job and get a refund of your retirement contributions, you can apply for it at your staff office, fill it out, and get it back. If you are no longer in federal service, you can get the right order from our website.

30-45 days have passed since the REFUND system is updated to verify the refund. Assuming the exact time is 30-45 days, it is 2 months from the time I received my paperwork until I can expect a check. The longest time would be just over 3 months.

How do I know my retirement account balance? If you are a current employee, you should contact your human resources office. If you are separated from federal service or are currently retired, you should contact the OPM Retirement Office at 1-888-767-6738 or retirement@opm.gov.

What is the average FERS retirement?

How much is that the same in pension income? FERS Pension = 1% x -3 salary x years worked. FERS Pension = 1.1% x-3 high salary x years worked. It is 1% – 1.1% of the highest annual salary in the federal service.

The average civilian employee who retired in 2016 was 61.5 years old and served 26.8 years in federal service. The average annual salary for employees who retired under the CSRS in 2018 was $ 4,973 per month. According to FERS, employees who retired received an average monthly income of $ 1,834.

The median private pension for people aged 65 and over was $ 9,827 per year. The median annual state or local government pension was $ 22,546.

| Age of household | Median income | Average income |

|---|---|---|

| Houses for 60-64 year olds | $ 70,031 | $ 100,842 |

| Houses aged 65 to 69 years | $ 60,324 | $ 88,291 |

| Housing from 70 to 74 years | $ 53,327 | $ 79,344 |

| Homes 75 years and over: | $ 37,335 | $ 58,644 |

What is my FERS minimum retirement age?

Although most federal jobs do not have a mandatory retirement age, many people – law enforcement officials, air traffic controllers, firefighters, and others – have to leave for a certain period of time.

FERS incomes are based on 3 high average salaries. Overall, the benefit is calculated as 1 percent of the average high 3 salary, multiplied by a reliable year-over-year service. For those who retire at least 20 years of age or older, a factor of 1.1 percent is used rather than 1 percent.

66 years – 67 years: Full Social Security retirement, depending on when you were born (see above). 70 years of age: The last age to start receiving Social Security benefits. Age 72: You need to start with the minimum distribution (RMD) of your retirement plan.

If you have a reliable civilian service for less than five years, you are not eligible for retirement. … If you have been in the service for 10 to 20 years, you will be entitled to a minimum retirement benefit at the minimum retirement age (between 55 and 57, depending on the year of birth).

What is a 59 minute rule in federal government?

(1) No component may place an employee on administrative leave for more than 30 consecutive days without the prior consent of the head of the component or his designee.

Federal employees are paid 4 hours of leave each time, every two weeks.

The federal government has a long-standing policy of granting workers a limited number of administrative permits in federal, state, regional, or municipal elections or in referendums on any civil matter in their community. … So administrative permits would rarely be needed.

All federal employees receive a paid 10-day vacation per year. See the 2019 federal holiday schedule.

Is $600000 enough to retire on?

How long will the $ 600,000 savings last? When will $ 600,000 end? Your savings will last for 34 years and 2 months.

| Monthly expenditure | He runs |

|---|---|

| $ 2,400 / month | 27.1 years |

| $ 3,600 per month | 16.4 years |

| $ 4,800 per month | 11.8 years |

| $ 6,000 a month | 9.2 years |

In the UK, you don’t have to wait until you reach retirement age until you reach state pension. You can enter your pension from the age of 55. This means that retirement at the age of 55 is a very real option for Britons in their fifties.

Keys to carry. You may retire at age 45, but it will depend on a number of factors. If you save $ 500,000, according to the 4% rule, you can get approximately $ 20,000 for 30 years.

How long will my FERS annuity last?

FERS is a retirement plan that offers benefits from three different sources: the Basic Benefit Plan, the Social Security and the Savings Savings Plan (TSP). … Then, after you retire, you receive a monthly income for the rest of your life.

According to the FERS, an employee who meets one of the following age and service requirements is entitled to an immediate retirement benefit: 62 years, five years of service, 20 with 60, minimum retirement age (MRA) with 30 or MRA with 10 (but reduced benefits).

FERS is paid in addition to the monthly income benefit, but unlike income, it is not a lifetime benefit. Since the additional FERS was created in the 1980s, it has sparked much debate.

According to the FERS, there is no limit to profitability, as it has a lower benefit calculation – 1 percent of the 3-year high of service, 1.1 percent if they retire at least 62 years or older with the service. Thus, even if there is an 80 percent limit, it would take 73 years of service to get there.

Is FERS mandatory?

Frequently Asked Questions Retirement Can an employee select FERS contributions? If the job is subject to FERS or CSRS deductions, deductions are mandatory. You can’t give up. There is a possibility of excluding TSP, but you would lose the match of the employer.

Contributions to the FERS Defined Benefit Pension Federal civil servants under the FERS must contribute a percentage of their salary to receive future defined benefit benefits from the defined benefit system. The amount of this contribution has changed several times recently due to changes in federal law.

If you want to leave your federal job and get a refund of your retirement contributions, you can apply for it at your staff office, fill it out, and get it back. If you are no longer in federal service, you can get the right order from our website.

Although most federal jobs do not have a mandatory retirement age, many people – law enforcement officials, air traffic controllers, firefighters, and others – have to leave for a certain period of time.

How much does a GS 13 make in retirement?

GS-12, Step 10, the rest of the U.S. pay is $ 95,388 in 2018. That’s used as 3, and with 30 years and less than 62 years, an annual income of $ 28,616 (with a survival of $ 25,754). At age 62 or older, that would be $ 31,478 ($ 28,330).

FERS incomes are based on 3 high average salaries. Overall, the benefit is calculated as 1 percent of the average high 3 salary, multiplied by a reliable year-over-year service. For those who retire at least 20 years of age or older, a factor of 1.1 percent is used rather than 1 percent.

The average civilian employee who retired in 2016 was 61.5 years old and served 26.8 years in federal service. In 2018, the monthly salary paid to employees who retired under the CSRS was $ 4,973. According to FERS, employees who retired received an average monthly income of $ 1,834.

Most current federal workers are covered by two pension plans: a defined benefit (DB) program, known as the Federal Employee Retirement System (FERS), and a defined contribution (DC) program, called the Thrift Savings Plan (TSP). … Most of the current federal employees also participate in the Social Security program.

How much does a GS 12 make in retirement?

If he retires with 30 years of service, the basic FERS retirement will provide 30% of the average high salary of three. GS has been at the 13-10 level for the past three years. The current salary is $ 113,007.

FERS incomes are based on 3 high average salaries. Overall, the benefit is calculated as 1 percent of the average high 3 salary, multiplied by a reliable year-over-year service. For those who retire at least 20 years of age or older, a factor of 1.1 percent is used rather than 1 percent.

The average civilian employee who retired in 2016 was 61.5 years old and served 26.8 years in federal service. In 2018, the monthly salary paid to employees who retired under the CSRS was $ 4,973. According to FERS, employees who retired received an average monthly income of $ 1,834.

Most current federal workers are covered by two pension plans: a defined benefit (DB) program, known as the Federal Employee Retirement System (FERS), and a defined contribution (DC) program, called the Thrift Savings Plan (TSP). … Most of the current federal employees also participate in the Social Security program.

How do I maximize my FERS retirement?

According to the FERS, there is no limit to profitability, as it has a lower benefit calculation – 1 percent of the 3-year high of service, 1.1 percent if they retire at least 62 years or older with the service.

You can start, stop or change your contributions at any time. Your TSP election will remain in effect until you run in another election or leave federal service. you contribute from your salary. made by the agencies in the TSP accounts of FERS employees who contribute their money to TSP.

5 Tips for Faster Retirement

- Reduce taxes to save more money on retirement. Consider using a health plan with a high deductible health savings account to cover health expenses for tax-free savings. …

- If you are dependent on the Federal Employee Retirement System, keep working. …

- Increase savings in TSP and elsewhere.

According to FERS, employees who retired received an average monthly income of $ 1,834. According to FERS, retiring employees have had a shorter average service life than CSR. FERS income is added to Social Security benefits and the Savings Savings Plan (TSP).

Can I retire after 20 years of federal service?

Under the CSRS, CSRS Offset, and FERS systems, the employee has the option to retire after meeting the minimum age and service requirements. … According to the CSRS / CSRS Offset, and the employee can retire at the age of 62 with five years of service, 60 with 20 or 55 with 30.

To qualify (if you leave federal service before retirement you are eligible for at least 5 years of civil service from the Basic Benefit Plan). Survival and disability benefits are available after 18 months of civil service.

If your agency offers you an early retirement according to the Voluntary Retirement Authority (VERA), you can retire at age 50 with 20 years of service or at age 25. However, your income will be reduced by 2% each year. (1/6 percent per month) If you are under 55 years of age.

If you leave your Government job before you have the right to retire: you can request a refund of your retirement contributions in one payment or. If you have a reliable service of at least five years, you can wait until you reach retirement age to claim monthly retirement benefit payments.

When should a federal employee retire?

If you have a reliable civilian service for less than five years, you are not eligible for retirement. … If you have been in the service for 10 to 20 years, you will be entitled to a minimum retirement benefit at the minimum retirement age (between 55 and 57, depending on the year of birth).

To qualify (if you leave federal service before retirement you are eligible for at least 5 years of civil service from the Basic Benefit Plan). Survival and disability benefits are available after 18 months of civil service.

The average civilian employee who retired in 2016 was 61.5 years old and served 26.8 years in federal service. In 2018, the monthly salary paid to employees who retired under the CSRS was $ 4,973. According to FERS, employees who retired received an average monthly income of $ 1,834.

When can you retire from a federal job?

If you have a reliable civilian service for less than five years, you are not eligible for retirement. … If you have been in the service for 10 to 20 years, you will be entitled to a minimum retirement benefit at the minimum retirement age (between 55 and 57, depending on the year of birth).

Typically, an employee is entitled to retirement from federal service when the employee has been in service for at least 30 years and is at least 55 years old under the Civil Service Retirement System or in the Federal Employee Retirement System for 56 to two months; is at least 20 years old and at least 60 years old; or has …

If your agency offers you an early retirement according to the Voluntary Retirement Authority (VERA), you can retire at age 50 with 20 years of service or at age 25. However, your income will be reduced by 2% each year. (1/6 percent per month) If you are under 55 years of age.

Your agency deducts the cost of the Basic Benefit and Social Security as a deduction from your salary. Your agency also pays its share. Then, after you retire, you receive monthly payments for a lifetime. The TSP portion of FERS is an account that your agency automatically configures.

What is a GS 12 equivalent to?

| Military Degree | Classification | Civil level |

|---|---|---|

| O-5 | Commander | GS / GM-13/14 |

| O-4 | Lieutenant Commander | GS-12 |

| O-3 | Lieutenant | GS-11 |

| O-2 | Lieutenant Junior Graduate | GS-7/9 |

GS-12 is the second most common grade after GS-13. Most of the employees with GS-12 are in engineering and engineering positions with several years of experience. The GS-13 rating is usually more difficult to achieve than previously achieved. So many employees will spend a few years in the GS-12 position before being promoted.

The starting salary of a GS-12 employee is $ 66,167.00 per year in Step 1, with a maximum annual payment of $ 86,021.00 being possible in Step 10. The basic hourly wage of a GS-12 employee is $ 31.70 per hour1.

In the case of federal civilian employees, GS-13 salary grades are consistent with those of senior officers in the military or navy. This is the equivalent of an army commander or an army commander.

Is it worth buying back my military time?

The Military Purchase Program is an advantage for all veterans with active duty military service to receive time for their military service with credit, add years of civil service with the government, and increase retirement income.

You are applying for a return to the military within three years of civil service and therefore no interest will be charged. In the case of civilian employees who have been in the military for more than three years prior to the purchase request, there may be interest charges.

But, if they make the decision to resume military service for 5 years, the pension will be $ 2,085 per month ($ 297 per month will be added). If we take into account the hypothesis of living at age 90, this adds $ 99,972 to the earnings of a lifetime pension.

There is a lot of confusion as to whether or not your military time is worth reclaiming. If you make a military deposit, it will not affect any of your other military benefits, such as medical benefits, basic access, commission or VA benefits, including VA disability payments.

How much money is in my FERS account?

How to enter a monthly income tax return

- Log in to your online account. Go to OPM Retirement Services online.

- Click the Annuity Statements menu.

- Select the payment period you want to view from the drop-down menu.

- Click the save or print icon to download or print the statement.

Federal employees who leave federal service have the option to withdraw retirement contributions or wait until retirement age to apply for retirement income, typically at the age of 60 or 62, depending on the years of service. This is called delayed retirement.

How much is that the same in pension income? FERS Pension = 1% x -3 salary x years worked. FERS Pension = 1.1% x-3 high salary x years worked. It is 1% – 1.1% of the highest annual salary in the federal service.

If you want to leave your federal job and get a refund of your retirement contributions, you can apply for it at your staff office, fill it out, and get it back. If you are no longer in federal service, you can get the right order from our website.

What happens to my FERS if I die?

The basic death benefit is equal to the employee’s final salary (or average salary, if higher) plus a lump sum of about $ 35,000, depending on annual inflation.

Your spouse will not receive survivors ’benefits if you die first in retirement. All FERS pension payments will be stopped upon your death and entitlement to federal health insurance will be accepted. The monthly pension is not reduced *.

If you choose a full surviving FERS survivor’s income – you will receive 50% of your monthly pension after your survival. This benefit comes at a cost. In most cases, it is 10% of the regular monthly FERS pension. Your FERS pension reduction is permanent.

FERS is a retirement plan that offers benefits from three different sources: the Basic Benefit Plan, the Social Security and the Savings Savings Plan (TSP). … Then, after you retire, you receive a monthly income for the rest of your life.

How much is FERS survivor benefit?

The spouse can receive the Basic Employee Death Benefit, which is 50% of the employee’s final salary (average salary, if higher), plus $ 15,000 (plus adjustments to the cost of living of the Civil Service Retirement System from 12/1/87).

Your spouse will not receive survivors ’benefits if you die first in retirement. All FERS pension payments will be stopped upon your death and entitlement to federal health insurance will be accepted. The monthly pension is not reduced *.

Basic Death Benefit of the Employee: 50% of the employee’s final salary (average salary, if higher), plus. $ 15,000 was added to the Civil Service Retirement System (CSRS) cost-of-living adjustments from 12/01/87. In the case of deaths as of 01/07/07, this amount is $ 28,093.53.

In most cases, survivors’ benefits depend on the amount the deceased received at the time he or she died from Social Security (or were eligible to receive it even if he or she died before claiming benefits). You can apply by phone at 800-772-1213 or by going to your Social Security office.

How much does Fegli cost in retirement?

When you retire, you make deduction options that determine whether your FEGLI life insurance (and premiums) are reduced at age 65 or when you retire, which happens later: Base with a 75% reduction: your basic coverage is reduced by 2% until you reach the monthly amount previously reduced % 25.

If you are 65 years of age or older, have retired, and have had coverage for at least 5 years, however, 25% of the remaining coverage remains the same at no cost. … If you haven’t gone through your mind yet, here it is: no one should leave FEGLI-Basic in retirement.

Unless you waive coverage, most federal employees have Basic Life Insurance in the Federal Employee Group Life Insurance Program. Basic Life Insurance is the same as the actual annual base rate (rounded to the next $ 1,000) plus $ 2,000 or $ 10,000, whichever is higher.

Optional FEGLI A option (standard): $ 10,000 death benefit. Your premium depends on your age and is between $ 0.20 every two weeks. Option B (Additional): Multiple your salary by up to five times your base salary (rounded to the highest $ 1,000).

Does spouse get federal pension after death?

The monthly annual income for the surviving spouse remains for life, unless the spouse is married before the age of 55. If your spouse has been married to you for at least 30 years, he or she can continue to receive benefits before he or she remarries before age 55. January 1, 1995.

The sudden amount benefit must be paid If an employee dies and does not survive his or her death, the remaining retirement contributions to the deceased Public Service Retirees and Disability Fund credit must be paid, as well as the applicable interest.

If you choose a full surviving FERS survivor’s income – you will receive 50% of your monthly pension after your survival. This benefit comes at a cost. In most cases, it is 10% of the regular monthly FERS pension. … When you die, the survivor will receive 50% of the pension for life.

Social Security is a major source of financial security for widowed spouses in old age. About 7.5 million people over the age of 60 receive benefits, at least in part, based on the work record of the deceased spouse. … When a retired employee dies, the surviving spouse receives the amount of the employee’s full retirement benefit.

How long does it take to get FERS retirement check?

In my experience, most federal employees will not receive their first retirement check until 3 months after retirement. And if all that goes well. I have seen that it took much longer until the first pension check arrived.

When will I get my first payment? In most cases, you will receive your first pension payment after about two or three weeks after your pension comes into effect.

30-45 days have passed since the REFUND system is updated to verify the refund. Assuming the exact time is 30-45 days, it is 2 months from the time I received my paperwork until I can expect a check. The longest time would be just over 3 months.

The normal time it takes for an retired or retired employee to pay for an unused annual vacation (the employee entering the same bank account that receives a direct deposit of their salary) is four weeks from the day the employee retires or leaves. .

What is FERS basic benefit?

What is the Basic Benefit of FERS. When you retire, the FERS will provide you with a monthly benefit for the years you have worked under the FERS, your income, and the age at which you retire. Therefore, the basic benefit is often known as monthly income. For this benefit, you pay 0.8% of the basic salary for each salary period.

You will receive fixed amounts with your FERS retirement pension and Social Security. With your TSP, the amount you receive depends on how much money you put in and how you managed the money. Your TSP contributions are optional and are separate from your FERS pension.

FERS is a retirement plan that offers benefits from three different sources: the Basic Benefit Plan, the Social Security and the Savings Savings Plan (TSP). Two of the three sections of the FERS (Social Security and TSP) can go with you to your next job if you leave the Federal Government before you retire.

Basic Benefit Plan A basic benefit plan is a pension that includes the amount established by the employee, regardless of the amount contributed. Amount of service life and & quot; high-3 & quot; average. & quot; High-3 & quot; it refers to the highest services provided for three consecutive years.

Sources :

Comments are closed.