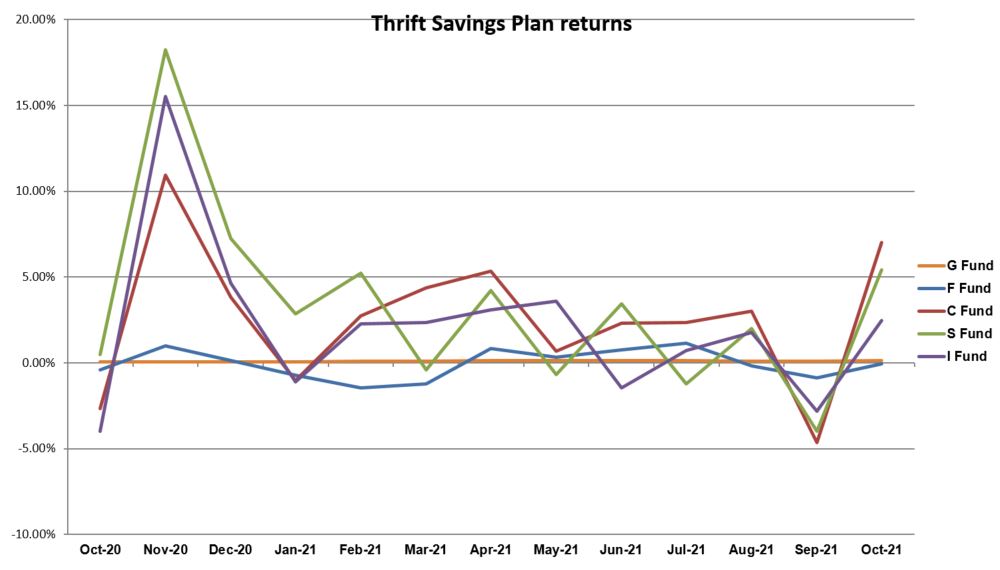

After a slow summer, all Thrift Savings Plan funds posted positive activity for the month of October, according to numbers released today.

The highest performance for stock funds was in the common stock index investment C fund, which ended October at 7% compared to -4.65% in September. The small capitalization stock index S fund had an October return of 5.43% compared to -4% in September, while the international stock index I fund had a monthly return of 2.46% compared to -2.81% in September.

The securities-backed G fund ended two straight months of 0.11% returns to end October at 0.13% — the same as in July — while the fixed income investment F fund, which still ended in the red, rose from -0.86% in September to -0.04% in October.

Year over year, all five stock funds’ returns for October were higher in 2021 than in 2020, with the largest improvement being in the C fund, according to Monday’s TSP numbers.

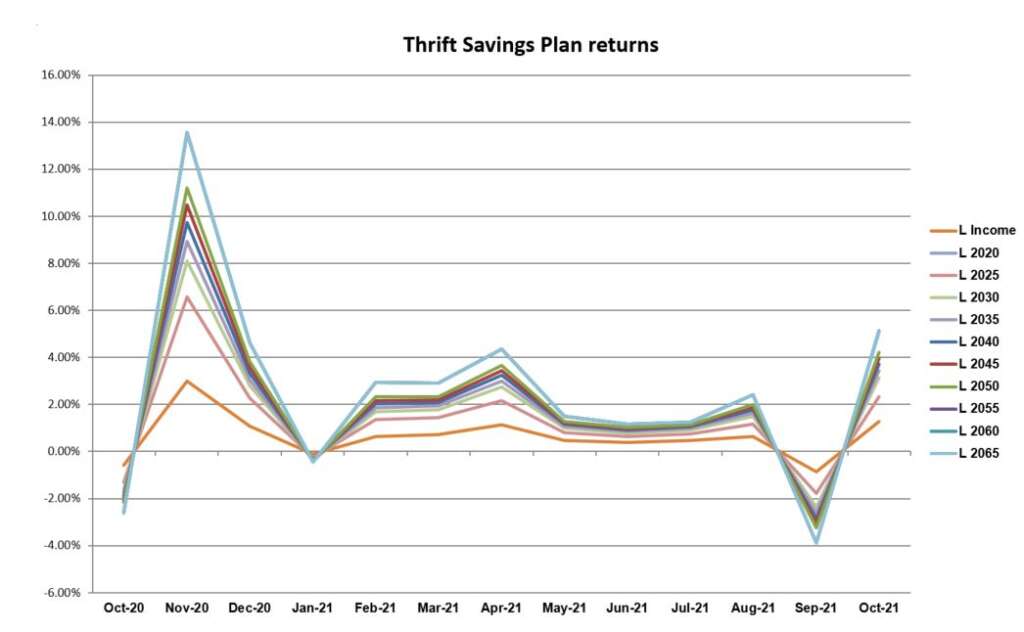

Lifecycle funds also saw monthly increases across the board, the largest being the L 2055, 2060 and 2065 funds. The L 2055 returns increased from -3.87% in September to 5.12% in October, while the L 2060 and L 2065 rose from -3.87% to 5.11%. These three funds also showed the highest increases year over year.

All lifecycle funds came out of the red last month. The L Income fund had a return of 1.28% compared to -0.87% in September. Year over year, it was up by 1.86 percentage points, according to Monday’s numbers.

| Thrift Savings Plan — October 2021 Returns | |||

| Fund | October | Year-to-Date | Last 12 Months |

| G fund | 1.12% | 1.26% | |

| F fund | -0.04% | -1.44% | -0.33% |

| C fund | 7.00% | 24.02% | 42.88% |

| S fund | 5.43% | 17.73% | 49.31% |

| I fund | 2.46% | 11.23% | 34.48% |

| L Income | 1.28% | 4.85% | 9.15% |

| L 2025 | 2.33% | 8.89% | 18.66% |

| L 2030 | 3.14% | 11.31% | 23.68% |

| L 2035 | 3.43% | 12.31% | 26.08% |

| L 2040 | 3.72% | 13.33% | 28.52% |

| L 2045 | 3.97% | 14.19% | 30.66% |

| L 2050 | 4.22% | 15.08% | 32.84% |

| L 2055 | 5.12% | 18.41% | 40.68% |

| L 2060 | 5.11% | 18.41% | 40.68% |

| L 2065 | 5.11% | 18.41% | 40.68% |

Comments are closed.