Investors in the TSPs stock index funds (C, S and I) have done very, very well for a long time.

The market has had its ups and downs (but mostly ups) since the end of the Great Recession in mid-2009. Most people didn’t see that one coming and few knew how or when it would end. Until after the fact, when investing your retirement nest egg is not real helpful.

The market hit an all time high in June. Since then it has been up and down as investors wait to see what (if anything) the Federal Reserve will do, and what the newest COVID mutation will do to our mostly unvaccinated fellow earthlings. In places like Africa. Or India. Or, closer to home, in Missouri and LA County.

Most of the TSP’s 98,000 plus millionaires hit the 7-digit mark by investing for the long haul (an average of 29-plus years), and investing largely in the C, S and I funds. And by staying in stocks and continuing to buy during bad patches, like the Great Recession. For a full picture of the TSP’s makeup as of June 30, click here.

But as they say, there’s always something. Which is why we called on financial planner Arthur Stein to co-host today’s Your Turn radio show. If you have questions send them to me at mcausey@federalnewsnetwork.com so the half of our team that knows what he’s talking about can answer them on air. I asked him to submit a guest column plugging the show. Here it is:

TSP Stock Funds Reach New Highs During the First Half of 2021

Share prices for the TSP stock funds (C, S and I) rose to record highs during the second quarter as a substantial decline in U.S. COVID-19 cases, increased vaccinations, economic re-openings, low interest rates (as a result of Quantitative Easing (QE) by the Federal Reserve) and fiscal stimulus led a surge in the economy. C Fund share prices hit a record high on June 30. The S and I Funds peaked a few days earlier.

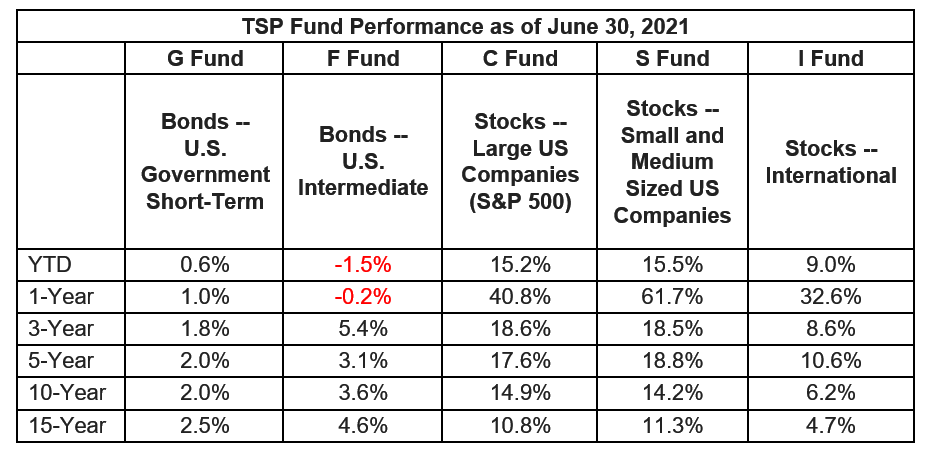

YTD and 1-year returns are Total Return for the period. One, three, five, ten, and fifteen-year returns are calculated as Compound Annual Returns. This is for illustrative purposes only. An investment cannot be made directly into an index. Past Performance is no guarantee of future performance. All investments involve various risks including loss of capital and volatility. Returns are rounded to tenths of a perfect. Returns include reinvestment of all income and do not account for taxes. The bond funds did not do as well. For the first six months of 2021, the F Fund declined 1.5% and the G Fund increased only 0.6%. The bond fund returns were less than the rate of inflation.

Market Outlook

There are many risks to current TSP Fund values, including:

- A COVID resurgence

- Change in Federal Reserve monetary policy (QE)

- Reduction in government stimulus (fiscal policy)

- Wars, revolutions, terrorist attacks, climate disasters, etc.

These and other risks have led some commentators to forecast significant market declines in the future.

Well, that’s not much of a forecast. Market declines are always going to happen at some point. Rising markets (Bull Markets) are eventually followed by falling markets (Bear Markets). Unfortunately, we don’t know (and forecasters, economists and market gurus can’t predict) the timing, length or magnitude of future Bear and Bull Markets.

That means stock and bond market predictions are not reliable or useful. We know that the stock market has historically rotated through Bull and Bear Market cycles. We are currently in a Bull Market. At some point it will become a Bear Market. But when?

Because sharp market declines are expected to occur at some point, TSP investors should plan for what they will do once the declines occur. There are multiple strategies, which Mike and I will discuss on today’s Your Turn show.

Nearly Useless Factoid

By Jonathan Tercasio

On this day (July 21) in 1861, Confederate troops won the First Battle of Bull Run, also known as the Battle of First Manassas, in Virginia. It was the first major battle of the U.S. Civil War.

Source: American Battlefield Trust

Comments are closed.