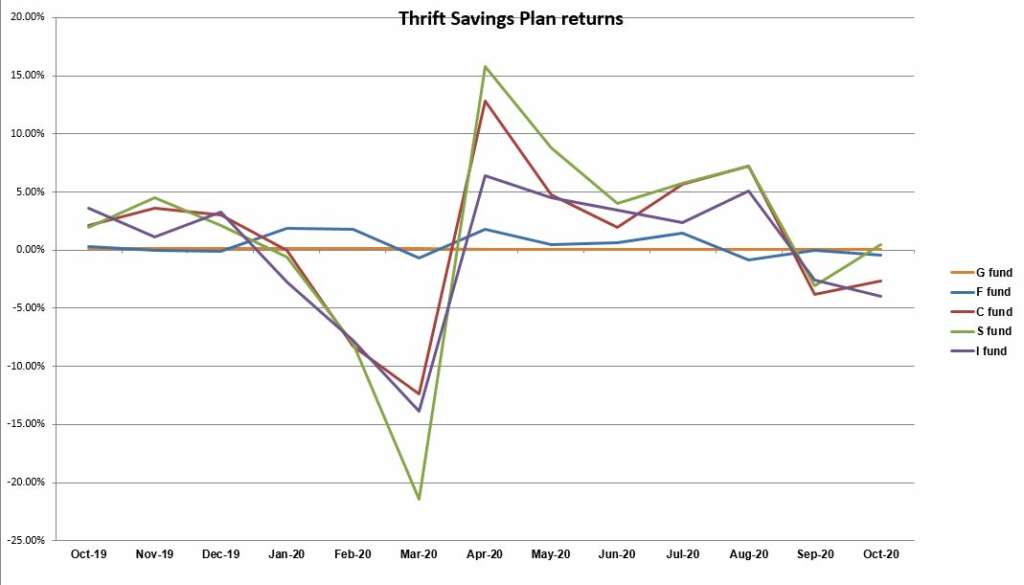

Despite slight performance improvements for most funds, the Thrift Savings Plan still had largely negative returns for the month of October, according to numbers released Monday.

The international stock index I Fund and the fixed income investment F fund went down from the previous month, while all other stock and Lifecycle funds increased or, in the case of the securities-backed G fund, stayed flat from September.

The I fund dropped from -2.60% in September to -3.97% last month, while the F fund fell from -0.03% to -0.42%. The small capitalization stock index S Fund improved from -3.04% to 0.50% in that time, and the common stock index investment C Fund rose from -3.80% to -2.66%. The G fund remained at 0.06% for the second consecutive month.

However, as a whole the TSP is performing more poorly than last October, with all funds showing a drop in returns this year compared to the same time in 2019.

So far the G Fund’s year-to-date return is 0.82% — a far cry from the 8.8% annual return it had when it was introduced in 1988. As Federal News Network reported last month, the G fund’s reputation for stability overlooks the fact that the last few years of economic uncertainty have driven more people to buy “safe” Treasury bonds, which raises the value and pushes down the returns.

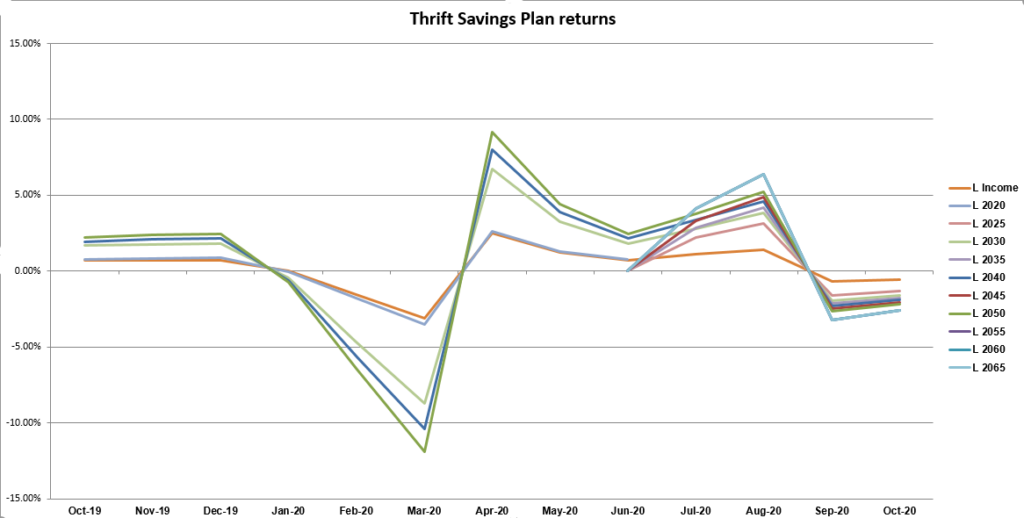

Among the Lifecycle funds, the highest performer was again the L Income, at -0.58% versus -0.66% last month. The lowest were the L 2055, L 2060 and L 2065 funds all with a -.260% return compared to -3.20% returns in September.

| Thrift Savings Plan — October 2020 Returns | |||

| Fund | Oct. | Year-to-Date | Last 12 Months |

| G fund | 0.06% | 0.82% | 1.13% |

| F fund | -0.42% | 6.30% | 6.16% |

| C fund | -2.66% | 2.69% | 9.62% |

| S fund | 0.50% | 3.97% | 11.02% |

| I fund | -3.97% | -10.53% | -6.57% |

| L Income | -0.58% | 1.01% | 2.48% |

| L 2025 | -1.30% | n/a | n/a |

| L 2030 | -1.61% | 0.12% | 3.76% |

| L 2035 | -1.76% | n/a | n/a |

| L 2040 | -1.91% | -0.21% | 4.07% |

| L 2045 | -2.04% | n/a | n/a |

| L 2050 | -2.17% | -0.56% | 4.27% |

| L 2055 | -2.60% | n/a | n/a |

| L 2060 | -2.60% | n/a | n/a |

| L 2065 | -2.60% | n/a | n/a |

Comments are closed.