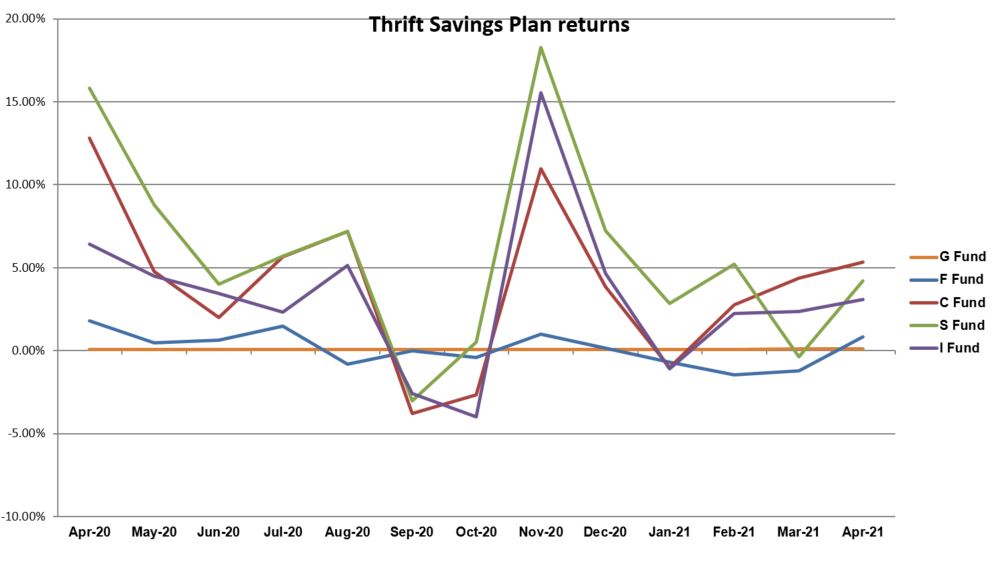

Monthly changes in the Thrift Savings Plan’s performance were somewhat positive in April but returns were still mostly down when compared to the same time a year ago.

According to monthly totals released by the TSP on Monday, the largest monthly increase from March to April was in the small capitalization stock index S Fund, which rose from -0.39% to 4.23 during that time. The second-highest improvement was in the fixed income investment F fund, which increased from -1.23% to 0.82%.

The common stock index investment C fund had an April return of 5.33% compared to 4.38% in March, while the international stock index I Fund’s April return was 3.09% versus 2.35% the month before.

The securities-backed G fund only rose from 0.11% in March to 0.13% in April.

When compared to April 2020, only the G fund was up while the other stock funds all had decreased returns. Last year, it wasn’t until May — about two months after the COVID-19 pandemic was in full swing — that the TSP saw a major plunge.

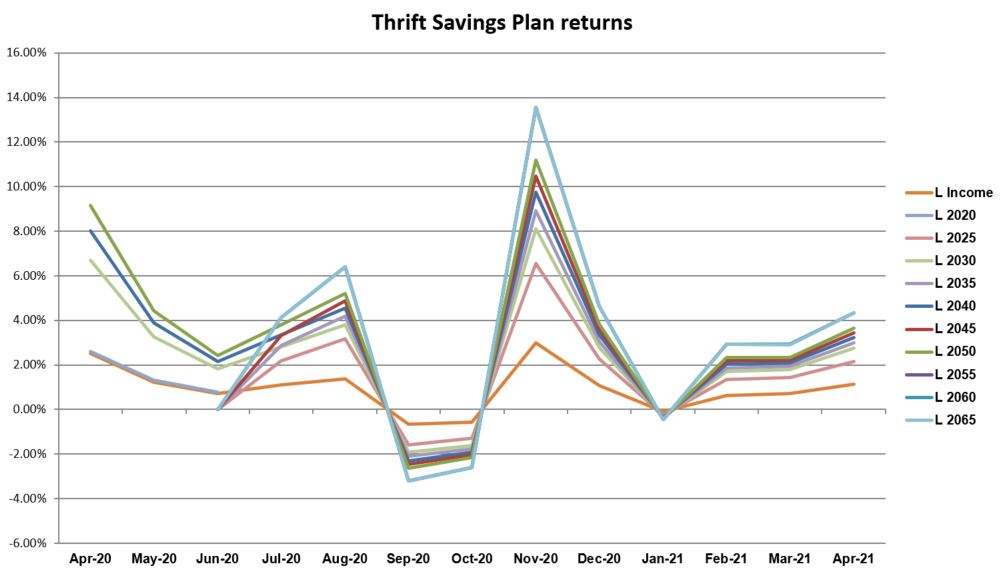

As for the Lifecycle funds, performance was fairly positive. All funds were up since March and year-over-year performance was mixed. The highest monthly change was in the L 2065 fund, which went from 2.91% in March to 4.35% in April. The highest yearly change was in the L 2055, 2060 and 2065 funds, each of which was up by 4.35 percentage points since April 2020.

The biggest drop from April 2020 to last month was in the L 2055 fund, according to Monday’s numbers. It finished last month at 3.66%, however, the fund was not introduced until June of last year so it does not yet have a full 12 months of performance history.

| Thrift Savings Plan — April 2021 Returns | |||

| Fund | April | Year-to-Date | Last 12 Months |

| G fund | 0.13% | 0.40% | 0.89% |

| F fund | 0.82% | -2.55% | -0.17% |

| C fund | 5.33% | 11.83% | 45.96% |

| S fund | 4.23% | 12.34% | 78.00% |

| I fund | 3.09% | 6.73% | 40.34% |

| L Income | 1.14% | 2.39% | 10.04% |

| L 2025 | 2.15% | 4.76% | n/a |

| L 2030 | 2.74% | 6.01% | 27.55% |

| L 2035 | 2.99% | 6.56% | n/a |

| L 2040 | 3.24% | 7.12% | 33.47% |

| L 2045 | 3.45% | 7.60% | n/a |

| L 2050 | 3.66% | 8.10% | 38.84% |

| L 2055 | 4.35% | 10.05% | n/a |

| L 2060 | 4.35% | 10.05% | n/a |

| L 2065 | 4.35% | 10.05% | n/a |

Comments are closed.