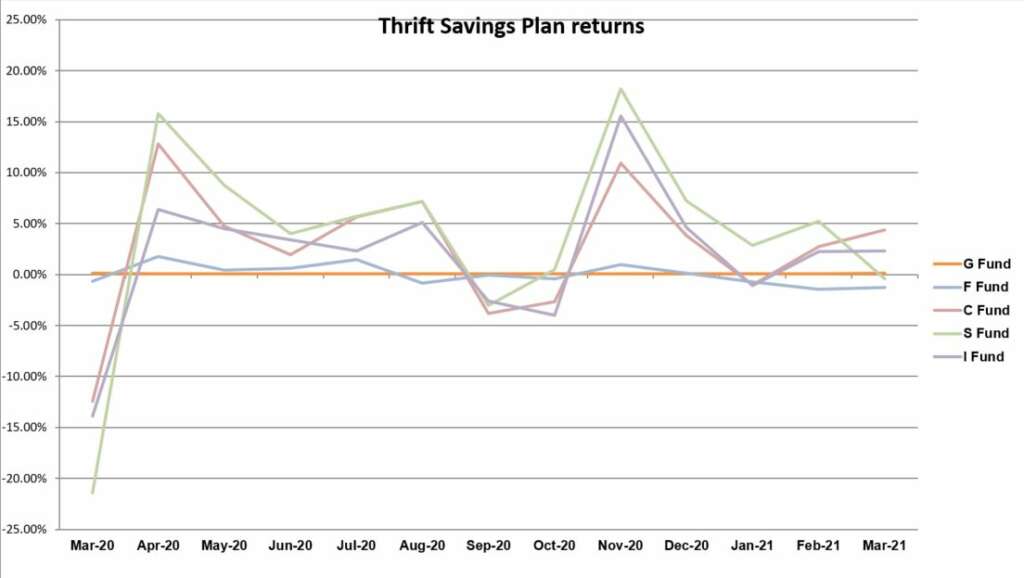

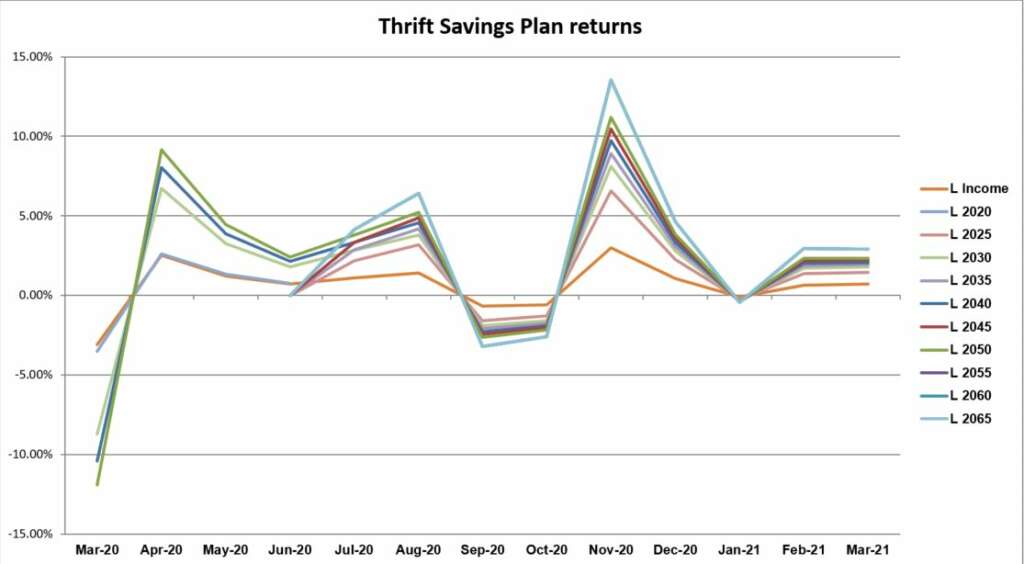

To say Thrift Savings Plan monthly returns have improved since this time a year ago is probably an understatement.

Last month, all funds except the fixed income investment F fund and the securities-backed G fund had higher returns compared to March 2020, when the pandemic was in full swing domestically. A year ago, most stock funds and all Lifecycle funds took an unprecedented plunge as global economic uncertainty and unusual activity by TSP investors— active feds and retirees unsure about their future — came to a head.

Year over year, the biggest improvement was in the small capitalization stock index S Fund, which finished last month at -5.60% compared to -21.40% in March 2020, according to numbers released by the TSP on Thursday.

Month-over month, however, the biggest increase was the common stock index investment C fund, which went from 2.76% in February to 4.38% in March 2021. The international stock index I Fund increased from 2.26% in February to 2.35% last month, and the F fund rose from -1.45% to -1.23% in that time.

The G fund increased from 0.08% in February to 0.11%. The G fund was unchanged from March 2020, while the F fund was down by 0.59% since then.

Among Lifecycle funds, all finished March in the black while three decreased in performance since the previous month: The L 2055, 2060 and 2065 funds. The biggest change from 2020 was the L 2050, which rose 14.23%, and the biggest monthly increase was the L 2025, which rose 0.09% since February.

| Thrift Savings Plan — March 2021 Returns | |||

| Fund | March | Year-to-Date | Last 12 Months |

| G fund | 0.11% | 0.27% | 0.83% |

| F fund | -1.23% | -3.35% | 0.77% |

| C fund | 4.38% | 6.17% | 56.32% |

| S fund | -0.39% | 7.79% | 97.79% |

| I fund | 2.35% | 3.52% | 44.87% |

| L Income | 0.71% | 1.24% | 11.54% |

| L 2025 | 1.44% | 2.55% | n/a |

| L 2030 | 1.78% | 3.18% | 32.49% |

| L 2035 | 1.93% | 3.46% | n/a |

| L 2040 | 2.08% | 3.76% | 39.66% |

| L 2045 | 2.20% | 4.01% | n/a |

| L 2050 | 2.33% | 4.28% | 46.20% |

| L 2055 | 2.92% | 5.47% | n/a |

| L 2060 | 2.92% | 5.46% | n/a |

| L 2065 | 2.91% | 5.46% | n/a |

Comments are closed.